Digital Edge Banking Services

Your one-stop solutions for banking in a decentralized digital economy.Core Competence in Financial & Banking Services

Digital Edge offer AI, Blockchain, and Big data platforms, products, and services that suitably blend with conventional software for creating a notable edge for customers worldwide.

Commercial Banking

Retail Banking

Payments

Consultants Services

Commercial Banking Covers

Commercial Lending

Liquidity and Treasury Management

Back Office Operations

Regulations and Risk Management

Commercial Banking

- We follow built-in analytics and workflow or particular modules.

- Our professionals help maintain the complete commercial account life cycle.

- Our Commercial Loan Origination combines robust decision management and business process capabilities.

Digital Edge’s solutions for corporate actions, tax reporting, data processing, collateral management, and reconciliation software help commercial banks in raising their standards on efficiency and operational control while they move ahead with their strategies in the future.

Digital Edge Ops

Ops ensures an agile recon with the help of:

Competence

Agility

Clarity

Process Control

Regulations and Risk Management

Our reporting and Risk Management Solutions help minimize liquidity risk concerning more scalable management of balance sheet, thereby providing you with the best strategic direction for addressing banking regulations such as interest rate risk within the banking book.

- Strategic support for capital and asset-liability management

- Operational and liquidity risk management

- Comply with notable regulations like IRRBB and IFRS 9

- Real-time cash analysis and accounting

- We offer solutions for liquidity trading, risk, cash management as well as treasury management solutions.

Treasury & Liquidity Management

- We help you leverage more value out of your treasury operations.

- We offer centralized treasury and liquidity management solutions for liquidity, cash management, risk trading, and more.

- You can easily streamline your treasury operations, standardize workflows and discover opportunities for making the most of your organization’s capital and liquidity.

Retail Banking Covers

- Branch Channel

- Cash Management

- Lending & Borrowing

- Audit

Digital Edge CBS Suitebranch

- We can help extend your bank system platforms thereby helping you engage with your customers and associates easily with Digital Edge CBS.

- It is a wide assortment of interactive models developed on a common enterprise architecture utilizing open digital API and real-time analytics.

Digital Edge CBS

Today cash management happens to be a heavily transaction-oriented phenomenon. It includes basic account management as well as payments. We help you collect and manage cash flows as it is one of the key components of your company's financial stability.

Retail Banking Covers

- Branch Channel

- Cash Management

- Lending & Borrowing

- Audit

Digital Edge CMMS

Decreased Operating Cost

Enhanced interest income

Decreased business risk

Improved efficiency

Unlock trapped cash

Decreased dependency on credit facilities

For making profitable lending and borrowing decisions, the most advanced securities finance information along with the ability to accurately and quickly analyze it is essential. Our solutions help you achieve that.

Retail Banking Covers

- Branch Channel

- Cash Management

- Lending & Borrowing

- Audit

Digital Edge CSMS Suite

- Reduced Investments and costs by shifting from x to x model

- Decreased Operational Costs by decreasing turnaround time with scalability and SLA tracking

- Data integrity with inbuilt information safety and security demands

- Enhanced Customer Experience by combining with multiple interactive channels and keeping clients well informed about the application status

- Enhance the agent’s productivity by our in-built collaborative features assisting relevant process owners to contribute well to the application procedure

Poor tax information reporting will end you up losing consumers. Therefore, we focus on superior tax information reporting that combines a proper tax character along with calculation amounts of security or payment concerning tax reporting purposes.

- Branch Channel

- Cash Management

- Lending & Borrowing

- Audit

Digital Edge Audity

- We help provide automated consumer outreach programs for managing and sourcing information.

- We help manage investor disclosures on behalf of consumers.

- Our solutions perform accurate reconciliation along with the settlement of withholding tax claims.

- We also conduct reporting and monitoring changes in particular circumstances.

Ranging from fraud prevention to network access, our wide range of solutions help in safe and secure commerce thereby supporting a secure point of sale, online, mobile, and additional electronic payment alternatives.

Payment Covers

- Commercial Payments

- Corporate Payments

- Loyalty & Rewards

- Analytics

Commercial Payments

- We offer a roadmap to the payment transformation strategy

- Our solutions help in the end to end system integration

- We help documentation and legacy re-engineering services

- We are specialized in implementation strategy and architecture definition

- We help in deployment services and payment engine selection

- Our solutions help with the decommissioning services and system migration

Corporate Payments

- Our corporate payments involve consolidated domestic and global payments

- We offer a full life cycle management on payment

- Payment execution, order management, and customer interaction come as brownie points

- We conduct cost-based routing

- We help with business process optimization and cost reduction

Loyalty & Rewards

- Multi-Channel capabilities – Performance by Channel

- Merchant Analytics – Net worth, Segmentation, Chargeback %, Fraud Category

- Consumer Buying Behavior – Predictions & Consumer

- Customer Acquisition & Churn Prediction

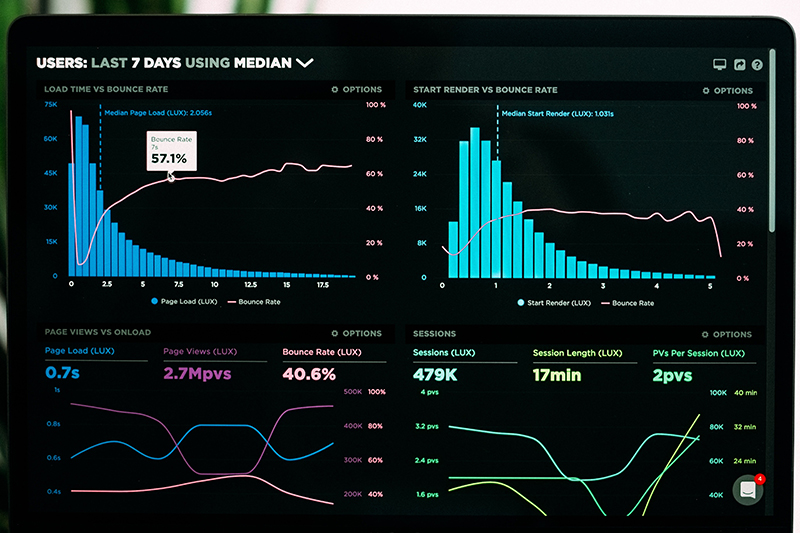

Analytics

Now you can unlock points of client engagement by assessing ATM and debit card transaction information throughout your entire portfolio. Analyze huge data sets streamline workflows and provide on-demand reports with the help of a customized interface. Analyze your whole debit portfolio by filtering and searching features that facilitate you in identifying and drilling down into transaction trends